Fraud is a pervasive and ever-evolving threat that organizations of all sizes and industries must grapple with. It can take many forms, from financial statement manipulation and asset misappropriation to bribery, corruption, and cybercrime. The consequences of fraud can be devastating, ranging from financial losses and reputational damage to legal liabilities and regulatory sanctions.route ) Fraud Risk

At the heart of effective fraud risk management lies a deep understanding of the various ways in which fraud can manifest. Fraudsters often exploit vulnerabilities in internal controls, leverage technological advancements, and capitalize on human weaknesses to carry out their nefarious schemes.

One of the most common forms of fraud is financial statement manipulation, where perpetrators deliberately misrepresent a company’s financial performance and position. This can involve the overstatement of assets, understatement of liabilities, or the recording of fictitious revenues. Such deception can have far-reaching implications, misleading investors, lenders, and other stakeholders, and potentially leading to catastrophic consequences for the organization.

Asset misappropriation is another prevalent form of fraud, where employees or third parties siphon off organizational resources for personal gain. This can take the form of theft, embezzlement, or the misuse of company assets. The consequences of asset misappropriation can be significant, eroding profitability, depleting resources, and undermining the integrity of the organization.

Bribery and corruption also pose substantial fraud risks, particularly for organizations operating in high-risk industries or jurisdictions. Perpetrators may engage in the payment of kickbacks, the manipulation of procurement processes, or the exploitation of regulatory loopholes to gain unfair advantages. The ramifications of such misconduct can include legal penalties, reputational damage, and strained relationships with stakeholders.

Cybercrime is an increasingly pervasive threat, as fraudsters leverage technology to infiltrate systems, steal data, and perpetrate various forms of fraud.

From phishing scams and malware attacks to data breaches and identity theft, the potential for technological vulnerabilities to be exploited is ever-present.

Assessing and Mitigating Fraud Risk

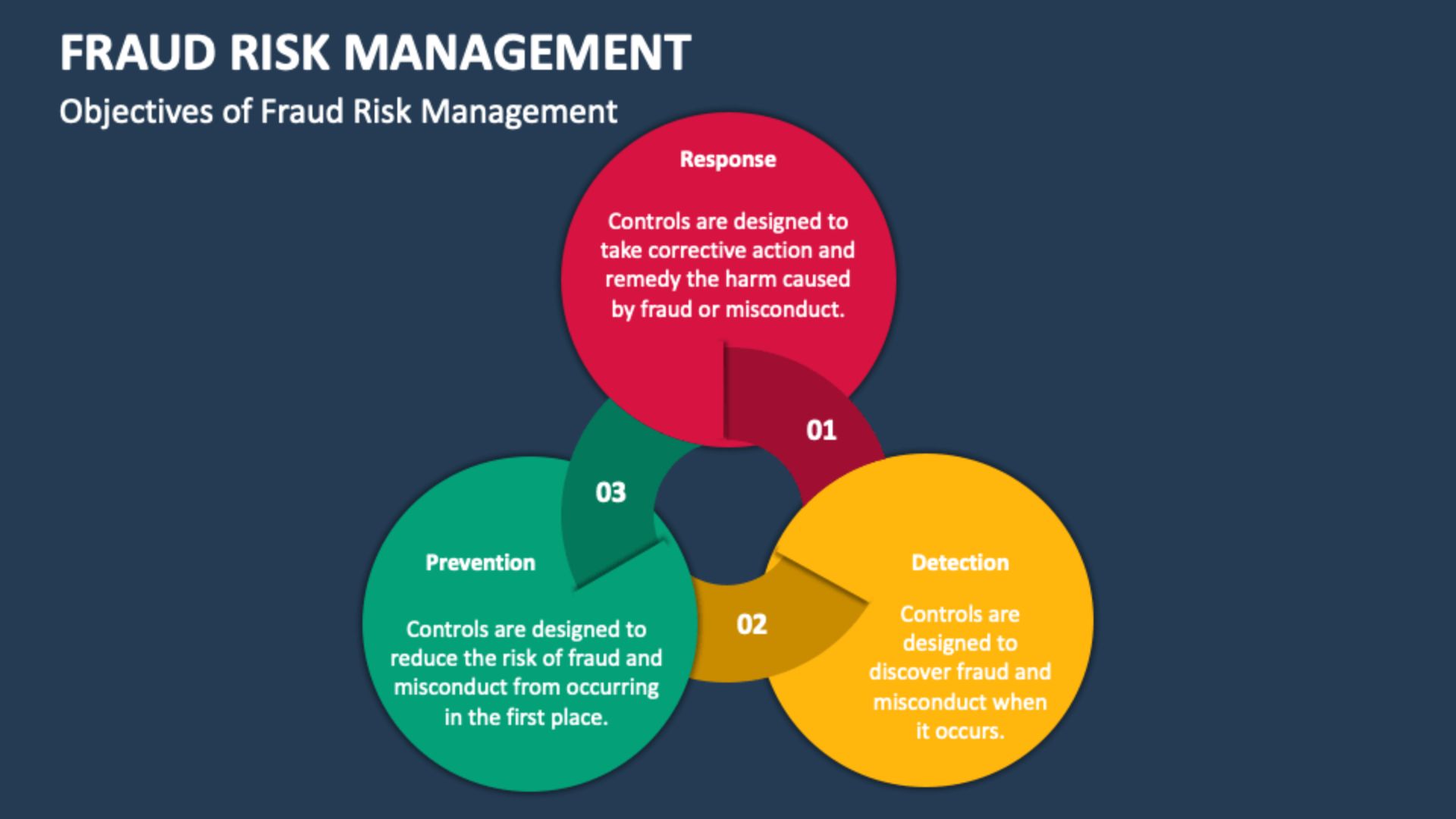

Effectively managing fraud risk requires a multifaceted approach that combines robust internal controls, continuous risk assessment,

and a strong culture of integrity and accountability.route ) Fraud Risk

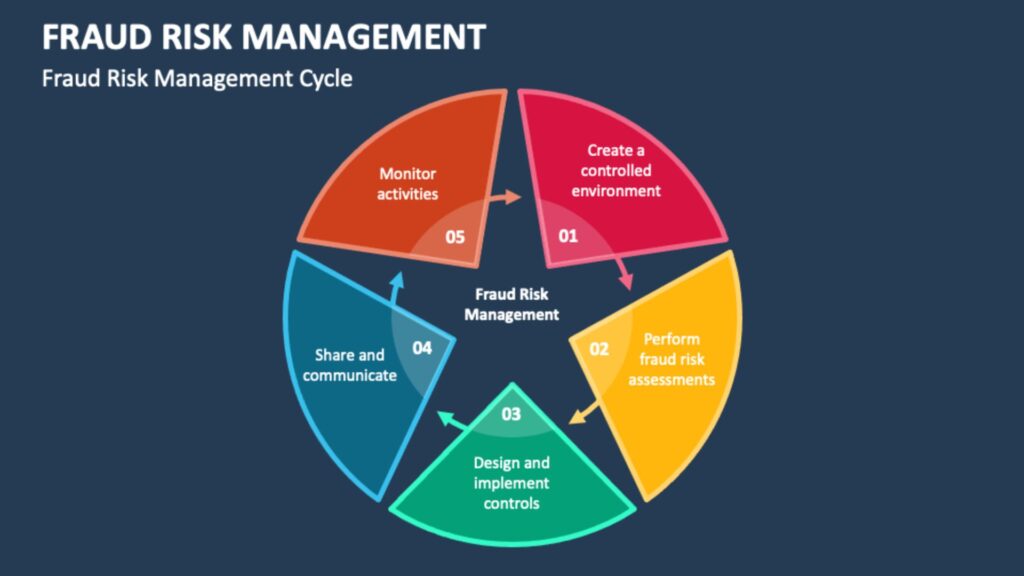

One of the key components of fraud risk management is the implementation of a comprehensive system of internal controls. This includes the segregation of duties,

the establishment of authorization thresholds, the implementation of physical and logical access controls, and the regular review and monitoring of transactions and activities.

Continuous risk assessment is also crucial, as the fraud landscape is constantly evolving. Organizations must regularly identify, evaluate, and prioritize their fraud risks,

taking into account factors such as the nature of their operations, the industry in which they operate,

and the regulatory environment in which they function.

Fraud prevention measures should be complemented by ongoing monitoring and detection efforts. This can involve the use of data analytics, forensic accounting techniques, and whistleblower programs to identify and investigate potential instances of fraud.

In the event of a suspected fraud incident, organizations must have a well-defined process for responding and investigating, with clear roles and responsibilities for key stakeholders. This may include the involvement of legal counsel, law enforcement, and forensic specialists to ensure a thorough and effective investigation.

Fostering a Culture of Integrity

Ultimately, the success of an organization’s fraud risk management efforts lies not only in the implementation of technical controls but also in the cultivation of a strong culture of integrity and ethical behavior.route ) Fraud Risk

Leadership plays a crucial role in setting the tone at the top and promoting a culture of transparency, accountability, and intolerance for unethical conduct. Senior executives must lead by example, demonstrating a commitment to ethical decision-making and the prioritization of fraud prevention and mitigation.

Organizations should also establish robust codes of conduct, training programs,

and communication channels to ensure that all employees,

from the C-suite to the front line, are aware of their responsibilities and the consequences of engaging in fraudulent activities.

Whistleblower programs, which provide confidential and secure channels for employees to report suspected misconduct,

can also be instrumental in the early detection and prevention of fraud.route ) Fraud Risk

Embracing Emerging Technologies and Data Analytics

As the nature of fraud evolves, organizations must stay ahead of the curve by embracing emerging technologies and data analytics capabilities.

Artificial intelligence (AI) and machine learning (ML) can be powerful tools in the fight against fraud,

enabling the detection of patterns and anomalies that would be difficult for human analysts to identify.

These technologies can be applied to a wide range of fraud detection and prevention use cases,

from transaction monitoring and anomaly detection to predictive modeling and risk scoring.

The increased availability of data and the ability to analyze it in real-time can also enhance an organization’s fraud risk management efforts.

By leveraging data from multiple sources,

including financial records, customer interactions, and third-party intelligence,

organizations can gain a more comprehensive understanding of their fraud vulnerabilities and implement targeted mitigation strategies.

Navigating the Regulatory Landscape

Fraud risk management is not only a matter of organizational resilience but also a matter of regulatory compliance. Organizations must navigate a complex and evolving landscape of laws,

regulations, and industry standards that govern the prevention, detection, and reporting of fraudulent activities.

Compliance with regulations such as the Sarbanes-Oxley Act, the Foreign Corrupt Practices Act,

and anti-money laundering (AML) legislation is essential for organizations operating in regulated industries. Failure to adhere to these requirements can result in significant legal and financial consequences, including fines, sanctions, and reputational damage.

In addition to regulatory compliance, organizations must also be mindful of the reporting and disclosure obligations that may apply in the event of a fraud incident.

Timely and transparent communication with relevant authorities,

stakeholders, and the public can be crucial in mitigating the impact of a fraud event and preserving the organization’s credibility.

Collaborating with External Stakeholders

Effectively managing fraud risk often requires collaboration with external stakeholders, such as law enforcement agencies, industry associations, and regulatory bodies.

By sharing information and best practices with these stakeholders,

organizations can gain valuable insights into emerging fraud trends, industry-specific vulnerabilities, and effective mitigation strategies. This collaborative approach can also facilitate the coordination of anti-fraud efforts and the development of collective defense mechanisms.

Furthermore, organizations should establish strong relationships with their financial institutions, legal counsel,

and other third-party service providers to ensure a coordinated and comprehensive response in the event of a fraud incident.

Conclusion

Navigating the treacherous landscape of fraud risk requires a multifaceted and proactive approach that combines robust internal controls, continuous risk assessment,

and a strong culture of integrity and accountability. By embracing emerging technologies, leveraging data analytics, and collaborating with external stakeholders, organizations can enhance their ability to prevent, detect,

and respond to fraudulent activities.

Ultimately, the successful management of fraud risk is not just a matter of organizational resilience,

but also a testament to an organization’s commitment to ethical business practices and its responsibility to its stakeholders.

By prioritizing fraud risk management, organizations can safeguard their assets,

preserve their reputation, and maintain the trust of the communities they serve.