Leveraging Multi-Domain Expertise and Collaboration

Effectively addressing fraud risk requires collaborative efforts and the integration of expertise from various domains. By fostering cross-industry partnerships and knowledge-sharing initiatives, stakeholders can enhance their fraud risk management capabilities.Multi Domain Resources and Services – Fraud RiskMulti Domain Resources and Services – Fraud Risk

- Industry Associations and Regulatory Bodies:

- Participation in industry groups, forums, and working groups to stay updated on emerging fraud trends and best practices.

- Engagement with regulatory agencies to ensure compliance with evolving guidelines and standards.

- Collaborative efforts in developing and implementing industry-wide fraud prevention frameworks.

- Law Enforcement and Cybercrime Task Forces:

- Reporting and sharing of fraud-related intelligence and evidence with law enforcement agencies.

- Participation in cybercrime task forces and joint investigations to disrupt and prosecute fraud perpetrators.

- Leveraging law enforcement resources and expertise in fraud investigation and prosecution.

- Academic and Research Institutions:

- Collaboration with universities and research centers to leverage advanced analytical techniques and predictive modeling.

- Sponsoring research initiatives to explore emerging fraud threats and develop innovative fraud detection and prevention solutions.

- Accessing fraud-related data sets and case studies to enhance organizational understanding and response strategies.

- Technology and Service Providers:

- Partnering with specialized fraud detection and prevention service providers to access cutting-edge technologies and expertise.

- Integrating fraud risk management solutions with existing business processes and systems.

- Participating in vendor-led training and knowledge-sharing programs to stay informed on the latest fraud mitigation strategies.

Leveraging Data and Analytics for Fraud Risk Mitigation

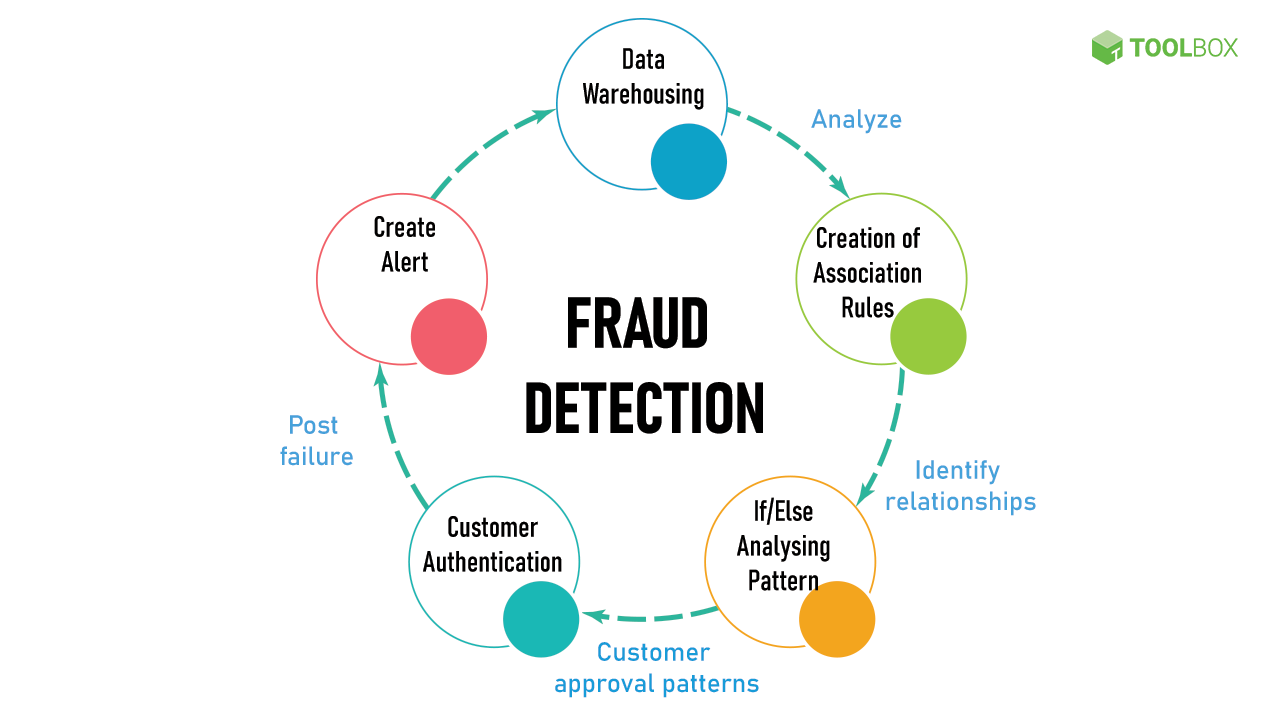

Data-driven insights and advanced analytics play a crucial role in effectively detecting, preventing, and responding to fraud across multiple domains.Multi Domain Resources and Services – Fraud Risk

- Data Integration and Aggregation:

- Consolidating data from various sources, including financial transactions, customer profiles, online activities, and cybersecurity logs.

- Implementing robust data governance and quality management practices to ensure the reliability and integrity of data.

- Leveraging data lakes and data warehousing solutions to enable comprehensive data analysis and reporting.

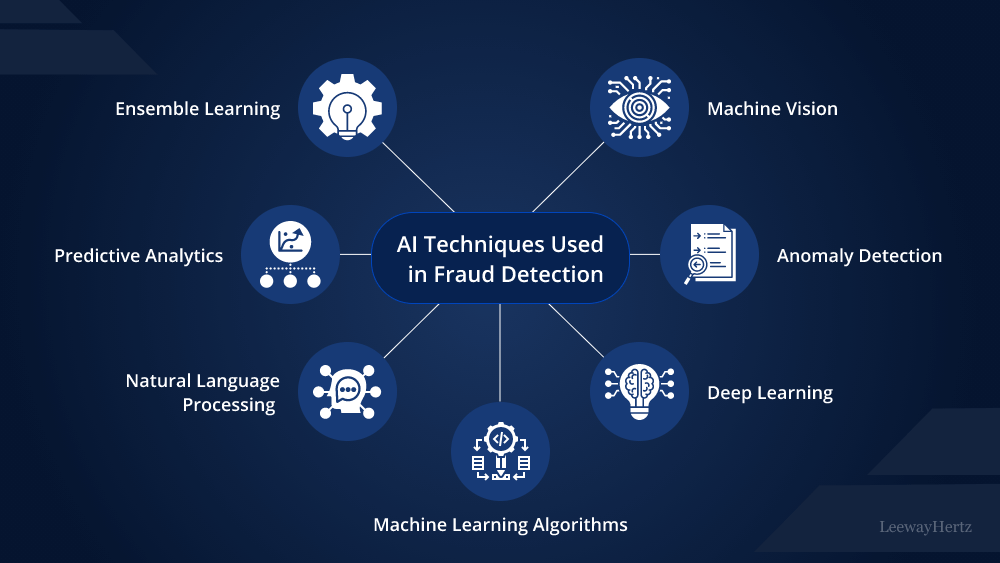

- Advanced Analytics and Predictive Modeling:

- Applying machine learning and artificial intelligence algorithms to identify patterns, anomalies, and emerging fraud trends.

- Developing predictive models to assess the risk of fraud and proactively identify potential fraud instances.

- Continuously refining and updating analytical models to adapt to evolving fraud tactics and user behavior.

- Fraud Risk Scoring and Decisioning:

- Implementing real-time fraud risk scoring and decisioning mechanisms to assess the likelihood of fraudulent activities.

- Utilizing risk-based authentication and authorization protocols to enhance security and reduce the impact of fraud.Multi Domain Resources and Services – Fraud Risk

- Integrating fraud risk scoring with business processes and customer interactions to enable prompt and informed decision-making.

- Fraud Monitoring and Incident Response:

- Establishing comprehensive fraud monitoring and alert systems to detect and respond to fraud incidents in a timely manner.

- Implementing incident response protocols and playbooks to efficiently manage and mitigate the impact of fraud events.

- Conducting post-incident analysis and root cause investigations to identify vulnerabilities and improve future fraud prevention strategies.

Regulatory Compliance and Governance Frameworks

Regulatory compliance and robust governance frameworks play a vital role in ensuring the effectiveness of fraud risk management strategies across multiple domains.

- Regulatory Guidance and Compliance:

- Adhering to industry-specific regulations and guidelines, such as PCI DSS, GDPR, and HIPAA, to mitigate fraud risks.

- Implementing compliance monitoring and reporting mechanisms to demonstrate adherence to regulatory requirements.

- Collaborating with regulatory bodies and industry associations to stay informed on evolving compliance standards and best practices.

- Governance and Risk Management Frameworks:

- Establishing comprehensive fraud risk management frameworks that align with organizational objectives and risk appetite.

- Implementing robust internal controls, segregation of duties, and authorization processes to prevent and detect fraud.

- Regularly reviewing and updating fraud risk management strategies to address emerging threats and regulatory changes.

- Fraud Risk Assessments and Audits:

- Conducting periodic fraud risk assessments to identify and prioritize fraud vulnerabilities across the organization.

- Performing internal and external audits to evaluate the effectiveness of fraud prevention and detection measures.

- Incorporating fraud risk assessments and audit findings into the continuous improvement of fraud risk management strategies.

- Fraud Awareness and Training:

- Developing and implementing comprehensive fraud awareness programs for employees, customers, and stakeholders.

- Providing targeted training on fraud detection, prevention, and reporting to relevant personnel across the organization.

- Fostering a culture of vigilance and shared responsibility in addressing fraud risks.

By leveraging the expertise and resources from multiple domains, organizations can create a robust and resilient fraud risk management ecosystem. This holistic approach enables them to stay ahead of evolving fraud threats, maintain regulatory compliance, and build trust with their customers, partners, and shareholders.