In the intricate world of financial systems and corporate governance, fraud risk is a persistent concern. One specific area of interest is the INC-LOW fraud risk, a term referring to fraud risks associated with organizations or entities operating with low or minimal income. Despite their small financial footprint, these entities can pose significant fraud risks that, if not managed properly, can lead to substantial financial and reputational damage.

In the intricate world of financial systems and corporate governance, fraud risk is a persistent concern. One specific area of interest is the INC-LOW fraud risk, a term referring to fraud risks associated with organizations or entities operating with low or minimal income. Despite their small financial footprint, these entities can pose significant fraud risks that, if not managed properly, can lead to substantial financial and reputational damage.Understanding INC-LOW Fraud RiskUnderstanding INC-LOW Fraud Risk

This article delves into the complexities of INC-LOW fraud risk, exploring its various facets, underlying causes, and effective strategies for mitigation. By understanding these elements, stakeholders can better safeguard their organizations against potential threats.

What is INC-LOW Fraud Risk?

INC-LOW fraud risk pertains to the vulnerabilities and threats associated with organizations that report low income or revenue. These can include small businesses, non-profits, startups, and shell companies. While they may not handle large sums of money, their operational and structural characteristics can make them prime targets for fraud.

Characteristics of Low-Income Entities

Entities with low income often exhibit several defining characteristics:

- Limited Financial Resources: These organizations typically operate with minimal capital and revenue streams, making them more susceptible to cash flow issues.

- Simplified Operational Structures: They often have less complex structures and fewer employees, which can lead to less stringent oversight and internal controls.

- High Dependency on Key Individuals: Smaller entities often rely heavily on a few key individuals, whose actions can significantly impact the entire organization.

- Lower Scrutiny and Regulation: Compared to larger corporations, low-income entities may face less regulatory scrutiny, which can be exploited by individuals seeking to commit fraud.

Common Types of Fraud in Low-Income Entities

Despite their size, low-income entities can be vulnerable to various types of fraud. Here are some common forms:

Embezzlement

Embezzlement is one of the most prevalent forms of fraud in low-income organizations. It occurs when individuals entrusted with managing an organization’s funds misuse or siphon off these funds for personal gain. The reliance on a few key personnel often leads to situations where internal controls are weak, providing opportunities for embezzlement.Understanding INC-LOW Fraud Risk

Financial Statement Fraud

Even small entities may engage in financial statement fraud to appear more financially stable or attract investors. This type of fraud involves manipulating financial reports to present a distorted view of the company’s financial health. Techniques can include inflating revenues, underreporting expenses, or failing to disclose liabilities.

Expense Reimbursement Schemes

In smaller organizations, oversight of expense reporting can be lax, making it easier for individuals to submit fraudulent expense claims. This might involve exaggerating the costs of legitimate expenses, claiming reimbursement for personal expenses, or creating entirely fictitious expenses.

Supplier and Vendor Fraud

With fewer resources dedicated to vendor management and due diligence, low-income entities can be particularly vulnerable to fraudulent activities from suppliers or vendors. This can include overcharging, supplying substandard goods, or creating fake invoices for services that were never rendered.

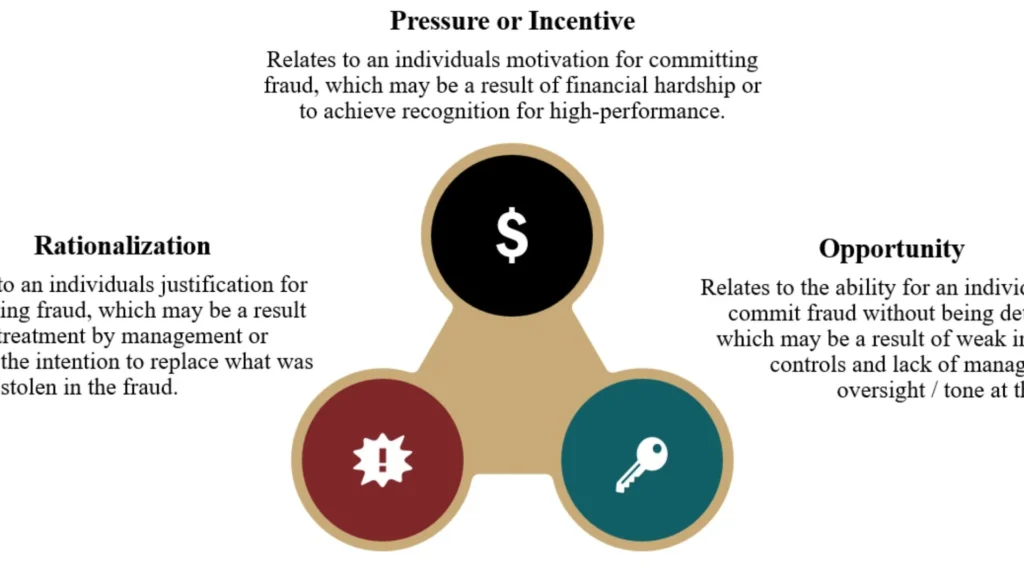

Drivers of Fraud in Low-Income Entities

Several factors contribute to the heightened risk of fraud in low-income entities:

Inadequate Internal Controls

Due to limited resources, many low-income entities may not invest sufficiently in robust internal controls. The lack of proper checks and balances creates opportunities for fraudulent activities to go undetected.

Pressure and Financial Stress

Entities with low or unstable income often face significant financial pressures, which can incentivize fraudulent behavior as a means of survival. Employees or executives may feel compelled to engage in fraud to meet financial targets or maintain operations.

Limited Oversight

Smaller entities usually have fewer layers of management and oversight. This limited supervision can allow fraudulent activities to occur without being noticed or addressed promptly.

Cultural and Ethical Environment

The ethical climate within an organization plays a crucial role in determining fraud risk. Low-income entities, particularly those with a high dependency on individual leadership, may develop a culture that either inadvertently tolerates or fails to discourage fraudulent behavior.

Impact of Fraud on Low-Income Entities

The consequences of fraud can be particularly devastating for low-income entities. Even relatively small losses can have significant impacts due to their limited financial buffers. Here are some potential repercussions:

Financial Damage

Fraud can lead to direct financial losses, which can be crippling for entities operating on thin margins. The recovery from such losses can be prolonged and challenging, affecting the organization’s ability to sustain its operations.

Reputational Harm

In many cases, low-income entities rely heavily on their reputation to attract clients, donors, or investors. Incidents of fraud can severely damage trust and credibility, leading to a loss of support and opportunities.

Operational Disruption

Dealing with the fallout of fraud can divert critical resources away from the organization’s core activities. This can disrupt operations and slow down growth or service delivery.

Legal and Compliance Costs

Fraud can lead to legal consequences, including fines and litigation costs, further straining the already limited resources of a low-income entity. Additionally, organizations may need to invest in improved controls and compliance measures to prevent future incidents.

Strategies to Mitigate INC-LOW Fraud Risk

Preventing and mitigating fraud risk in low-income entities requires a tailored approach that considers their unique characteristics and constraints. Here are some strategies that can be effective:

Strengthening Internal Controls

Even with limited resources, low-income entities can implement basic internal controls to safeguard against fraud. This might include segregation of duties, regular financial reviews, and implementing simple but effective accounting procedures.

Enhancing Oversight and Governance

Establishing clear governance structures and enhancing oversight can significantly reduce fraud risk. This can involve setting up advisory boards, involving external auditors, or engaging trusted stakeholders in monitoring activities.

Promoting Ethical Practices

Creating a strong ethical culture is vital for fraud prevention. This can be achieved through leadership commitment to integrity, clear ethical policies, and regular training and communication about ethical standards and fraud risks.

Leveraging Technology

Technology can be a powerful tool for preventing and detecting fraud. Low-cost accounting software and other digital tools can help streamline financial management and improve transparency and control over financial transactions.

Conducting Regular Audits

Regular financial and operational audits can help identify and address potential fraud risks early. Even simple, informal audits can be effective in detecting discrepancies and reinforcing accountability.

Case Studies of INC-LOW Fraud

To illustrate the impact and mechanisms of INC-LOW fraud risk, here are a few case studies from various sectors:

Small Business Embezzlement

A small retail business faced severe financial difficulties after a trusted employee was found to have embezzled significant funds over several years. The employee had been manipulating sales records and diverting cash. The fraud went undetected due to the absence of regular financial reviews and reliance on a single individual for cash handling and bookkeeping.

Non-Profit Financial Misrepresentation

A non-profit organization, in a bid to attract more donations, engaged in financial statement fraud by inflating its revenue and underreporting expenses. When the fraud was eventually uncovered, the organization faced significant reputational damage and lost donor trust, leading to a sharp decline in funding.

A tech startup fell victim to a vendor fraud scheme where a supplier charged for high-quality components but delivered substandard goods. The startup’s lack of due diligence and weak vendor management processes contributed to the success of the fraud. The financial losses and operational setbacks from dealing with the faulty components significantly impacted the startup’s growth trajectory.Understanding INC-LOW Fraud Risk

Vendor Fraud in a Startup

Regulatory and Legal Framework

Understanding the regulatory and legal framework surrounding fraud is crucial for low-income entities. Compliance with relevant laws and regulations not only helps prevent fraud but also protects entities from legal repercussions.Understanding INC-LOW Fraud Risk

Key Regulations

Many countries have specific regulations aimed at preventing and punishing fraud. These can include financial reporting standards, anti-money laundering (AML) laws, and specific regulations for non-profits and small businesses.

Legal Consequences

Entities involved in fraudulent activities can face severe legal consequences, including fines, penalties, and criminal charges. Additionally, victims of fraud can pursue legal action to recover losses, adding to the legal and financial burdens on the perpetrating entity.

Conclusion

INC-LOW fraud risk is a significant concern for low-income entities across various sectors. Despite their modest financial scale, these organizations can face substantial challenges and impacts from fraudulent activities. The combination of limited resources, weak internal controls, and financial pressures creates a fertile ground for fraud.

Addressing this risk requires a nuanced understanding of the specific vulnerabilities and a commitment to implementing tailored mitigation strategies. Strengthening internal controls, enhancing oversight, promoting ethical practices, leveraging technology, and conducting regular audits are critical steps in safeguarding against fraud.

By proactively managing fraud risk, low-income entities can protect their financial health, preserve their reputation, and ensure their long-term sustainability. Understanding and addressing INC-LOW fraud risk is not just about preventing financial loss—it’s about fostering trust, integrity, and resilience in the organizations that form the backbone of our economy and society.